Earnings projections remain quite rosy but prices, particularly the Nasdaq, are rolling over

FinTech BizNews Service

Mumbai, November 7, 2023: World Gold Council has today released Monthly Gold Market Insights.

October in Review

Looking Forward

Record month-end finish

Gold prices started the month on the backfoot, having fallen below US$1,850/oz at the end of September. The events in Israel in early October set a rally in motion that took the US dollar price back up above US$2,000/oz by 27 October. The record-high monthly finish was mirrored in almost all other major currencies.

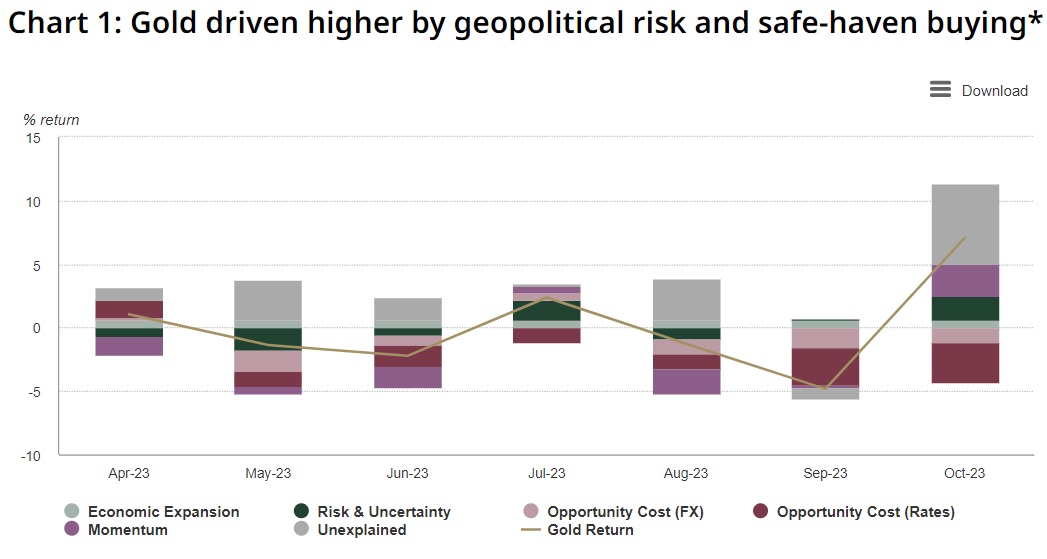

Our gold model GRAM attributed the bulk of this move to the residual, in this instance likely capturing a spike in geopolitical tension, which we discussed in a recent blog. The large contribution from a rise in implied volatility and breakeven inflation rates as well as the strength in the Swiss Franc (not in our model) pointed to safe-haven flows as a dominant motive. In addition, COMEX futures also weighed in, with short covering (-87t) and new longs (+84t) taking net longs higher by 171t (US$11.3bn).

Despite positive flows in futures, global gold ETFs saw another month of outflows (-US$2.2bn, -38t), two thirds from North America and one third from Europe. By the end of the month, flows appeared to have troughed with a small pick up towards the end of the month partly driven by options expiry in the US.

Gold price and return in different periods across key currencies*

| USD (oz) | EUR (oz) | JPY (g) | GBP (oz) | CAD (oz) | CHF (oz) | INR (10g) | RMB (g) | TRY (oz) | AUD (oz) |

31 October 2023 price | 1,997 | 1,888 | 9,738 | 1,643 | 2,771 | 1,818 | 53,452 | 470 | 56,516 | 3,151 |

October return | 6.8% | 6.7% | 8.4% | 7.2% | 9.1% | 6.2% | 7.0% | 7.0% | 10.2% | 8.4% |

Y-t-d return | 10.1% | 11.5% | 27.4% | 9.5% | 12.7% | 8.4% | 10.8% | 16.8% | 66.5% | 18.4% |

(Data to 31 October 2023. Based on the LBMA Gold Price PM in USD, expressed in local currencies)

Looking forward

October was a big month for gold. The sharp sell-off at the end of September was forcibly rejected by week two of October and since then, gold hasn’t looked back.

The geopolitical flare up in Israel was undoubtedly a factor, but central bank activity may also have been a strong contributor. What we know for certain is that COMEX managed money futures positions reached another extended net short at the beginning of October, just over a year since the previous instance. That one helped produce a 25% gold price rally over the following six months. Net shorts positions have a habit of producing good subsequent returns for gold as we noted last August. On 10 October, a z-score reading of -2 was reached,1 and the subsequent short covering and long creations combined with an almost 10% rise in the US dollar price, suggest a good chance that history will repeat itself.

The other positive news for gold is that ETFs blinked in October. After months of steady outflows, a trickle of inflows appeared and flows look to have levelled off. In our February 2023 GMC we found that futures tend to lead ETFs even when accounting for reporting differences. These two sources of demand have been absent for much of this year, with central banks, Asian bar and coin buyers and some OTC investment taking the baton.

It is possible that with a full house of investment behind it including ETFs and futures, gold could break out of the broad range in which it has traded since the middle of 2020. But we believe one or more factors are required for this to occur.

Geopolitical environment stays volatile or gets worse: A continuation or escalation of the current elevated geopolitical tension is likely to dampen economic sentiment, disrupt supply chains and risk higher energy prices – likely driving developed market economies towards stagflation risks. The difference between this geopolitical tension and that of last year (the onset of the Ukraine war) is the likelihood that it compounds rather than replaces existing tensions.

Equities entering a bear market: Earnings projections remain quite rosy but prices, particularly the Nasdaq, are rolling over. The index is down more than 10% already from its mid-year peak during what is supposedly the seasonally strongest period. A greater than 20% drop from the peak – a ‘bear market’ - could spur additional interest in gold from investors, concerned perhaps that equity dips are no longer worth buying. Recent bear markets have been kind to subsequent gold returns.

Bond yields probably need to peak, but it might not be plain sailing for gold when they come down. They are only likely to do so if inflation is perceived to be comfortably heading towards target. That would then make bonds attractive again from both a more compelling real return and a likely lower bond-equity correlation.

In summary…

Whether an uptrend through US$2,000/oz is established or not, the past two years have cemented not only gold’s ability to maintain its cool in a turbulent environment. It has shown that demand for gold can come from various uncorrelated sources and help prices defy over-simplified notions of what drives them. A break out from the current range is likely to require a catalyst. We think one or more of the following are candidates: a geopolitical escalation, a peak in bond yields or an equity bear market. Until then, we think it likely that prices remain quite choppy as we outlined in our last GMC.

October gold ETF data