Dollar index and the US treasury yields pared some gains

Kaynat Chainwala,

Yadnesh Shengde,

Commodity Research, Evening Track

Kotak Securities

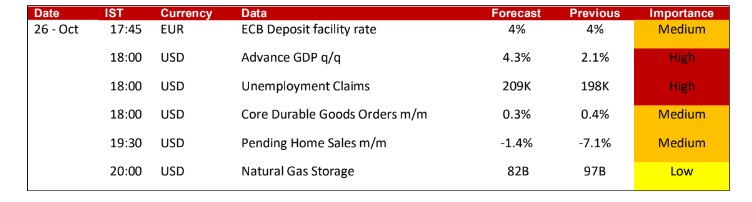

Mumbai, 26 October, 2023: Dollar index and the US treasury yields pared some gains ahead of a slew of US economic data and ECB policy meeting. Markets are widely anticipating the European Central Bank to keep rates on hold today, which might put more focus on balance sheet discussions Meanwhile, Israel’s military said it made a limited ground raid into northern Gaza with infantry and tanks before withdrawing, ahead of a full scale ground invasion which is expected to begin soon, as US is seeking to bolster air defenses in the Middle East to protect American troops stationed there COMEX Gold prices extended gains as concerns of escalation in the middle-east conflict keeps the war premium high. Any signs of de-escalation might prove to be bearish for the yellow metal LME base metals are trading mixed as higher interest rate environment coupled with growing pessimism on Chinese property sector weighed on the demand prospects

Oil prices eased as weak seasonal demand outweighed supply concerns. Crude runs at refineries sank to the lowest since March, while implied gasoline demand on a four-week basis edged higher but remains more than 5% down from the 5-year seasonal average European natural gas prices advanced on signs Israel will proceed with a ground invasion of Gaza, adding to concerns that the war could widen and disrupt energy supplies. For the day, focus might be on the US Q3 GDP preliminary estimates, ECB policy meeting and weekly jobless claims data.

RATING SCALE FOR DAILY REPORT

BUY - We expect the commodity to deliver 1% or more returns.

SELL - We expect the commodity to deliver (-1%) or more returns.

SIDEWAYS- We expect the commodity to trade in the range of (+/-)1%.

(NOTE: The recommendations are valid for one day from the date of issue of the report, subject to mentioned stop loss, if any. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice.)