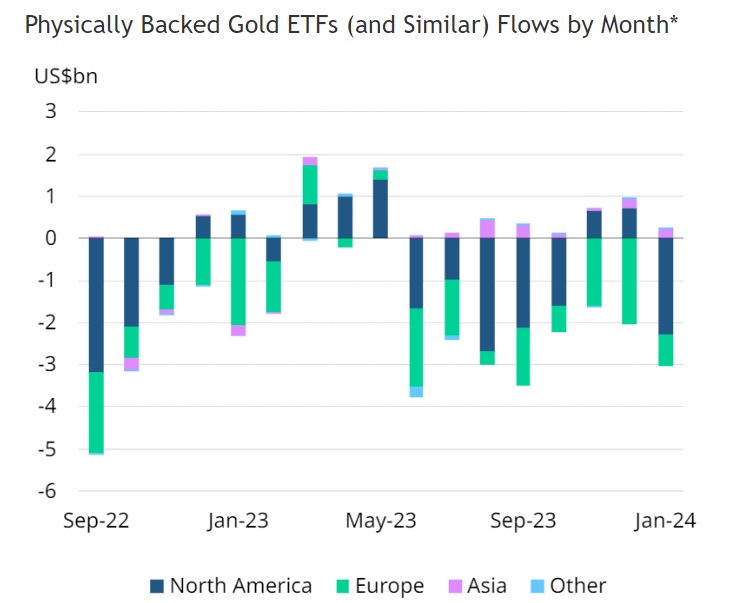

Global gold ETFs kicked off 2024 with the eighth monthly outflow (-US$2.8bn), led by North America (-US$2.3bn)

FinTech BizNews Service

Mumbai, February 7, 2024: Global gold ETFs kicked off 2024 with the eighth monthly outflow (-US$2.8bn), led by North America (-US$2.3bn), according to the January 2024data released by the World Gold Council on 7th February, 2024.

•European funds continued to see outflows (-US$720mn) while Asia registered their 11th consecutive monthly inflow (+US$215mn)

•As the market pushed back against bets on early rate cuts by major central banks, gold prices retreated in January, dimming North American and European investors’ interest in gold ETFs

•Collective holdings of global gold ETFs fell by 51t to 3,175t; meanwhile, total AUM lost 2%, arriving at US$210bn

Regional and fund-specific analysis of gold holdings and flows in USD

Gold-backed ETFs and similar products account for a significant part of the gold market, with institutional and individual investors using them to implement many of their investment strategies. Flows in ETFs often highlight short-term and long-term opinions and desires to holding gold. The data on this page tracks gold held in physical form by open-ended ETFs and other products such as close-end funds, and mutual funds. Most funds included in this list are fully backed by physical gold.

Highlights

January in review

Global physically backed gold ETFs began 2024 with US$2.8bn outflows in January, stretching their losing streak to eight months.2 This was equivalent to a 51t reduction in global holdings, to 3,175t by the end of January. Meanwhile, total assets under management (AUM) fell to US$210bn, a 2% decline due to outflows in the month and a 1% gold price fall.

Overall, North America led global outflows and European funds continued to see heavy losses. Asia captured another inflow while fund flow changes in the Other region were limited.

January regional overview

North American funds pared losses of US$2.3bn in January, snapping the emerging trend of inflows during the previous two months. Recent robust US economic data has led investors to reassess their bets on the Fed’s first rate cut in March – the probability priced in by swap markets fell sharply.4 As a result, both the dollar and the 10-year Treasury yield rebounded, weighing on the gold price and leading to sales of gold ETFs. And with US equities reaching new highs, local investors’ appetite for gold was further dented. After January’s decline, collective holdings of North American funds fell to the lowest since April 2020. As usual, the largest funds saw the heaviest outflows during the month.

Europe had its eighth consecutive monthly loss in January. Nonetheless, the US$730mn outflow has significantly narrowed compared to the previous month (-US$2bn). Although the European Central Bank (ECB) held rates unchanged for the third successive meeting in January, officials have been vocal in delivering the message that the market may have gone too far in pricing early rate cuts. And this gave local investors a reality check, pushing back their bets on lower interest rates ahead and fuelling notable rebounds in the region’s government bond yields and currencies. Combined with lacklustre performances of gold prices in the area, investors continued to dial down their gold ETF holdings. Meanwhile, FX-hedged funds accounted for another chunky part of European outflows. Following eight straight monthly falls, total holdings of the region’s funds slipped to the lowest in four years. Funds listed in Germany and Switzerland lost the most.

Asian funds added US$215mn in January, extending their inflow streak to 11 months. China continued to dominate the region’s inflows as the sixth consecutive monthly fall in local equities and a weaker currency lifted investors’ safe-haven demand. The Other region experienced limited changes in gold ETF demand, adding US$8mn in the month, mainly contributed by South Africa. It is worth mentioning that the losses from FX-hedged products were the main reason for the region’s 0.4t reduction in holdings.

Globally, low-cost gold ETFs saw their eighth consecutive monthly outflow in January, losing US$207mn (-4t). North America (-US$243mn) drove global outflows while low-cost funds in Europe registered inflows (+US$32mn.)5 Following January’s loss, the total AUM of low-cost funds declined by 1% to US$55bn. Meanwhile, their collective holdings fell to 832t, the lowest since April 2021.