While gold has provided stability in regions facing economic challenges, India’s stronger currency and robust equity performance have outpaced gold returns, showcasing the resilience of Indian markets.

FinTech BizNews Service

Mumbai, 23 October, 2024: DSP Mutual Fund in it's latest edition of the October 2024 Netra report has highlighted: Gold has outperformed equity markets in local currency terms across all markets, except for India, where equities have shown stronger returns. The question arises WHY?

Gold has traditionally been an essential diversification asset due to its superior returns compared to equities. However, India stands as a notable exception. While gold has provided stability in regions facing economic challenges, India’s stronger currency and robust equity performance have outpaced gold returns, showcasing the resilience of Indian markets.

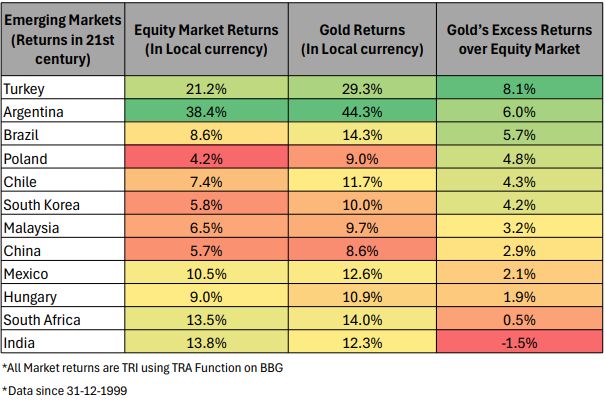

We have outlined some of the major Developed and Emerging Markets (EMs), and across all markets, the Multi Asset strategy has achieved optimal outcome. In some cases, it has outperformed domestic equity in local currency terms. Another critical point to note is that over this 20-year period, Gold has outperformed equity markets in local currency terms across all markets, except for India.

The important point to highlight here is the difference in standard deviation, because most of the times a dismal period in one asset class will be offset by another asset class.

Emerging Markets

In emerging markets, Gold is an indispensable diversification asset.

Diversifying with gold is essential for emerging market portfolios due to its consistent outperformance compared to equities in most regions. Gold has delivered superior returns in local currencies across emerging markets, driven by economic and political instability, which often weakens currencies and boosts gold prices.

While India stands out with a more stable currency and strong equity performance, many other emerging markets face chronic challenges that make gold a valuable asset. India is the only exception, at this point, where local stocks are beating gold. But this isn’t the case always.

Including gold in a portfolio acts as a hedge against volatility, protecting against risks while enhancing overall returns. For investors in emerging markets, gold offers both stability and growth potential in uncertain times.

The Winner’s Curse

The Winner's Curse: In auctions with several bidders for a commodity of uncertain value, the winning party typically overpays. As a result, the "winner" ends up with an overpriced asset, which can lead to lower or negative returns in the future.

This pattern is common in equity markets and other assets globally. When a country’s equity market significantly outperforms, the likelihood of future underperformance increases.

Examples of the winner's curse include the Dot-Com bubble, the Japanese stock market bubble, the U.S. housing boom in the 2000s, and the Chinese market boom in 2007. During these periods, the hype often seemed never-ending, supported by unshakable justifications.

However, history shows that there are no "new eras"—only cycles. Impermanence always prevails.

India’s Outperformance Gap Widens To A Record As Emerging Markets Struggle

India has outperformed S&P 500 Index even during a strong USD phase, diverging significantly from other EMs. The 4yr rolling CAGR of relative performance of India over US vs EM over US favours India and is currently at a differential of 18.2% CAGR, the highest number registered ever.

A large part of underperformance of Emerging markets can be attributed to the underperformance of China. Over the last few weeks, China has enacted a preliminary stimulus to help put a check on the slowing economic growth. If Chinese equities make a comeback, it could quickly command a large share of its missing foreign investor flows.

It would be difficult for India to hold on to this outperformance given its 90% premium to Ex India EM basket.

India Receiving Flows At The Cost of China Was A Mirage, Passive Flows To EM is What Matters

The false narrative, that India would likely receive Foreign institutional investment flows because China is not doing well, never played out.

There is another narrative which is devoid of logic – Investment flows can cause high returns a.k.a. liquidity chasing. Note how institutional inflows into Indian equities, both from FIIs and MFs have coincided with performance and DO NOT lead to performance. In fact, when seen from a valuation perspective, $86Bn worth of flows, which are equivalent to nearly 6 years of flows, have come in at the top quartile of valuations for Indian equities.

In fact, as per the historical data, India receives strong FII inflows when FII flows towards global, especially emerging, equities are positive & strong. The reason is that most of FII inflows are passive in nature and are deployed in proportion to emerging market weights.

That’s another data telling you that flows chase returns and do not cause them.

3 in 4 Investors Haven’t Experienced A Bear Market!

Markets have been on a steady upward trend since the COVID-19 lows, driven by a combination of loose fiscal policies, liquidity inflows, and historically low interest rates which fueled the credit binge in 2020 to 2022.

The ongoing market rally has resulted in triple-digit returns for many small and mid-cap stocks, attracting a growing number of investors, many driven by fear of missing out (FOMO).This trend is reflected in the surge of new investor demat accounts and the unprecedented number of new investors in small-cap funds.

Small-cap stocks have been the market's focal point for the past four years, delivering exceptional returns, while large-caps have largely been neglected by investors.

In fact, for the first time in history, the number of small-cap fund investors has surpassed that of large-cap fund investors. However, 75% of these new small-cap investors have never experienced a bear market. The critical question remains: how many will survive the next bear market ?

The Unsettling Calm – The Steady Move Stretches Further

Nifty Index has now spent 370 days above its 200 Day Moving Average (200DMA). 200DMA is the smoothened price move of the index and the time spent above it indicates the stable and steady move higher. Nifty Index is also a healthy 12% away from its 200DMA. This is nowhere close to its record number of 51% (last 30 years). To put this into context of price moves, it is critical to note the slope of the 200DMA. In a bear market, when prices are declining, the 200DMA also moves lower. A price bottom post a market crash is followed by a quick recovery. During such a phase the price moves quickly away from a ‘still falling’ 200DMA and thus these record readings are made during the aftermath of a bear market.

What, is then, the significance of the time spent and distance from 200DMA currently?

Market up moves become shallower as they elongate. Notice how price finds it harder to move further from the 200DMA as time spent above 200DMA rises. Eventually this becomes an indicator of a slowing rate of change or a slowing momentum of the bull market. In the current market scenario, the momentum has slowed enough to let the bull market take a pause or a tumble.

There Is A Flood of Funding, Almost Too Easy To Raise Capital

In previous editions of 'Netra,' we discussed how government capital expenditure remains strong but operates largely in isolation, providing an initial boost to demand. This push is expected to attract private investment. However, let’s revisit an earlier stage of capital expenditure—capital raised.

The chart highlights a sharp increase in corporate fundraising post-pandemic. While bank credit was traditionally the primary source, equity and corporate bond issuances have grown significantly over the past four years.

In the equity space, 63% of funds raised in the last year came from IPOs, with the rest from additional offerings. However, the key question remains: how much of this capital will be directed towards productive capex? Corporate bonds are another major fundraising avenue. Of the ₹23 trillion in outstanding bonds issued over four decades, about one-third was issued post-pandemic. While much of this fundraising targets capital-intensive sectors, concerns remain over how much of this capital raised will translate into actual spending.

How Much Did Promoters Sell In The Ongoing Equity Dilution Spree?

In the last month’s DSPNetra, we had seen that the equity dilution levels were reaching the highs seen two decades ago - ‘23% of the small & mid cap companies have seen promoter share of ownership come down in the Jun-24 quarter.’

The pace of selling has especially seen a significant acceleration in the last two years with the rally in SMID stocks. In the past year, the promoter selling in just the SMID (Small & Midcap) category stocks based on our estimates are at Rs 1.4 lakh crores.

While the surging sale of promoter stake may not be a cause for concern on these businesses, it does highlight some concern on the valuations at which some of the SMID companies are currently trading.