Gold market broadens; expansion in physical and financial holdings

FinTech BizNews Service

Mumbai, September 20, 2024: Gold demand stabilises and remains strong; festive season is momentum key, states Kavita Chacko - Research Head, India, World Gold Council, as part of her research report, providing India’s gold market update.

Gold experienced strong gains in August, with international prices rising 3.7% and domestic prices by 3.9%, driven by expectation of easing interest rates in the US and the resultant drop in the US dollar. Gold’s strength was extended to September; the international and domestic price has increased by 2.8% and 1.6% respectively, at the time of writing.

Despite these gains, domestic prices remain 2% below their levels before the Union Budget announcement (on 23 July), due to the 9% reduction in import duty.

LBMA Price AM and domestic landed price by month, US$ and INR*

*Based on the LBMA Gold Price AM in USD expressed in local currency as of 13 September 2024. Landed price includes import tariff and tax.

Following an initial surge in consumer demand (for jewellery and bars and coins) due to the sharp import duty cut, demand is reported to have since normalised. However, market reports indicate that overall buying momentum remains healthy, with an uptick compared to the period before the import duty reduction. Purchases previously deferred are now materialising, and there is increased interest in heavier pieces of jewellery. Industry participants anticipate that this momentum will continue, though they are closely monitoring the crucial festive and wedding season sales that run through late August to December. Media and market reports indicate that festive buying has started on a strong note.1

Rural consumption demand has been showing signs of improvement and given the favourable monsoons and higher crop sowing this year, economic conditions there are expected to improve. This could lead to increased gold buying interest, particularly during the ongoing festive period.

The rise in international gold prices, combined with increased supply from higher imports has led to a narrowing of the spread between domestic and international gold prices. Following the import duty cut announced on 23 July, domestic gold prices initially traded at a premium 2 of US$5-US$28/oz over international prices from late July to mid-August. Wholesalers and bullion dealers, facing losses on inventory purchased under higher import duties, increased their prices up to offset these losses. However, a strong initial spurt in consumer demand enabled adjustment in inventory valuations. In recent weeks, amid the normalising, but still healthy demand, domestic gold prices have been trading either at a slight discount to or in line with international prices.

NCDEX gold premium/discount relative to international price

*As of 13 September 2024. Source: NCDEX, World Gold Council

Since the end of July, Indian gold ETFs have seen a surge in investor interest. The import duty cut and the changes to the long-term capital gains for gold ETFs announced in the Union Budget have been factors behind the increased inflows into gold ETFs. Our initial estimates based on partial information pointed to another positive month for Indian funds. And according to the Association of Mutual Funds (AMFI), August saw record gross fund inflows of INR 21bn (~US$238mn),3 significantly higher than the average monthly (gross) inflows of INR8bn during H12024. Net inflows for the month also reached a record INR16bn (~US$192mn).

As of the end of August, the total assets under management (AUM) for Indian gold ETFs, as reported by AMFI have increased to INR374bn(~US$4.4bn), marking an 8% m/m rise and 54% y/y increase. So far in 2024,4 net inflows into Indian gold ETFs have amounted to INR61bn(~US$735mn), a significant increase from INR15bn in the same period last year, according to AMFI data. These funds have collectively added 9.5t of gold this year, bringing their total gold holdings to 51.8t, which represents a 29% y/y increase.

The steady inflow into Indian gold ETFs reflects a global trend of expanding investments in gold ETFs, driven by lower opportunity cost, strong gold price performance, and safe haven demand.

Monthly gold ETF fund flows in INRbn and total holdings in tonnes*

*As of end August 2024. Source: Bloomberg, company filings, AMFI, CMIE, World Gold Council

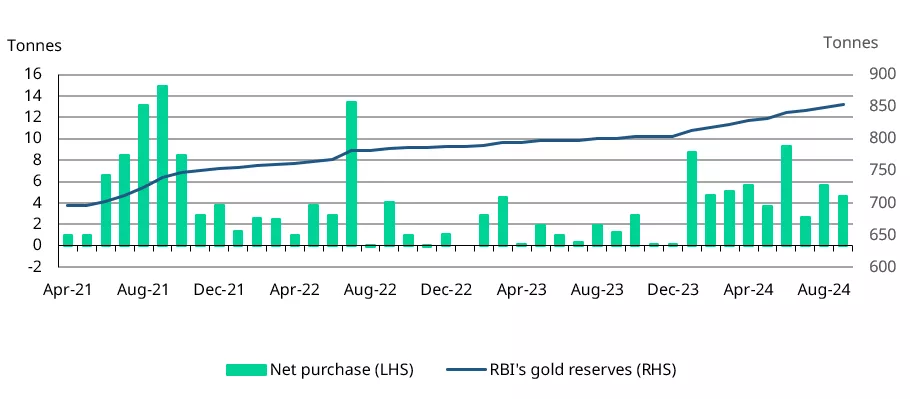

The Reserve Bank of India’s demand for gold remains strong, as evidenced from its recent purchases. According to RBI data and our estimates, the central bank acquired a total of 10.3t of gold over the six weeks leading up to 6 September.5 Over the first eight months of the year, the RBI has purchased a total of 50t of gold, with acquisitions in each month. This accumulation significantly surpasses the net purchases of 2022 and 2023.6 The RBI has emerged as a leading gold buyer this year.

The RBI’s gold reserves have now reached a record 853.6t, accounting for 9% of its total foreign reserves, up from 7.5% a year ago.

RBI’s monthly net purchases and reserves; in tonnes*

*Data as of 13 September 2024. Source: RBI, World Gold Council

August saw a new record for gold imports, totaling US$10.1bn. This represents over a threefold increase compared to the previous month and double the value from a year ago. Our estimates suggest that in volume terms, imports for the month were approximately 140t, a more than threefold increase from the previous month. This surge can be attributed to the reduction in import duties announced towards the end of July and increased seasonal demand for gold ahead of the festive period. For the period from January to August, gold imports have risen by 30% y/y, reaching US$32bn.