Loan losses and provisions was Rs748 crore for the quarter ended September 30, 2025 compared to Rs431 crore for the quarter ended September 30, 2024.

FinTech BizNews Service

Mumbai, October 14, 2025: A meeting of the Board of Directors of HDB Financial Services Limited was held in Mumbai on Wednesday, October 15, 2025 to consider and approve the unaudited financial results for the quarter and half year ended 30th September 2025.

Performance Highlights – Q2FY26:

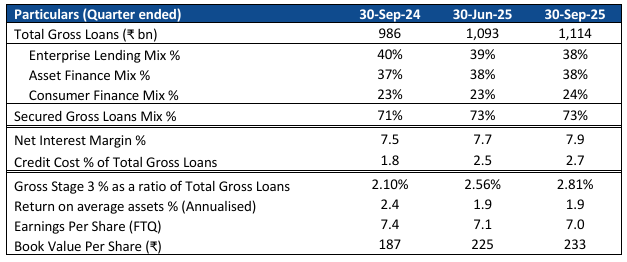

· Asset under management (AUM) was Rs 1,11,721 crore as on September 30, 2025 compared to Rs 99,076 crore as on September 30, 2024, a growth of 12.8%.

· Total Gross Loans stood at Rs 1,11,409 crore as on September 30, 2025 compared to Rs 98,624 crore as on September 30, 2024, a growth of 13.0%.

· Net interest income was Rs 2,192 crore for the quarter ended September 30, 2025 compared to Rs 1,833 crore for the quarter ended September 30, 2024, an increase of 19.6%.

· Net total income was Rs 2,851 crore for the quarter ended September 30, 2025 compared to Rs 2,408 crore for the quarter ended September 30, 2024, an increase of 18.4%.

· Pre-provisioning operating profit was Rs 1,530 crore for the quarter ended September 30, 2025 compared to Rs 1,230 crore for the quarter ended September 30, 2024, an increase of 24.4%.

· Loan losses and provisions was Rs 748 crore for the quarter ended September 30, 2025 compared to Rs 431 crore for the quarter ended September 30, 2024.

· Profit before tax was Rs 782 crore for the quarter ended September 30, 2025 compared to Rs 799 crore for the quarter ended September 30, 2024.

· Profit after tax was Rs 581 crore for the quarter ended September 30, 2025 compared to Rs 591 crore for the quarter ended September 30, 2024.

· Profit after tax was Rs 1,149 crore for the half year ended September 30, 2025 compared to Rs 1,173 crore for the half year ended September 30, 2024.

· Gross Stage 3 loans was at 2.81% as against 2.10% as at September 30, 2024.

· Net Stage 3 loans was at 1.27% as against 0.83% as at September 30, 2024.

· Provision Coverage stood at 54.73% on stage 3 assets as against 60.69% as at September 30, 2024.